How will play-to-earn level the playing field for emerging markets? YGG advisor Anirudh Pai underscores how Axie and YGG are pioneering the future of work and new organizational models that will transform the global economy.

Anirudh Pai is a partner at On Deck and an advisor for YGG. Anirudh Pai is a partner at On Deck and an advisor for YGG. Previously, he was a VC at Conversion Capital. He is also the creator of the Dreams of Electric Sheep newsletter where he writes about secular trends in history, economics, and technology. Anirudh has a byline at Athwart Magazine. We are delighted to have Ani author our first Crypto Tonight guest post.

“I am tormented with an everlasting itch for things remote. I love to sail forbidden seas.”

– Herman Melville

Hi all, Ani here.

The last century was unquestionably a story of globalization – the tide and ebb of ideas, capital, and people between nations. Like all momentous narratives, it had an abrupt climax in the summer of 1914 and a gradual, yet storied rise after the end of the Second World War. Unexpectedly, the latter half of the 20th century saw globalization’s peak, immediately the universe widened and markets across Asia, Eastern Europe, South America, and the Middle East began to reach levels of economic prosperity their ancestors had only imagined.

This transformation was so revolutionary in Asia, namely Hong Kong, Singapore, South Korea and Taiwan, that investors dubbed them the Asian Tigers for their roaring, and seemingly limitless, runaway growth. In a few generations, these economies emerged from primarily agricultural hubs into bastions of economic potential: Taiwan’s TSMC produces the most efficient computer chips – TSMC and South Korea’s largest Chaebol, Samsung, control over 70% of the world’s foundry market.

Before the interference of the CCP, Hong Kong was the jewel of the east, rivaling New York in all its financial and artistic glory; Singapore is perhaps the most remarkable growth story of all time, starting off as a wayward island after independence to now controlling the Port of Singapore, the world’s busiest seaport. Today, the International Monetary Fund includes the Asian Tigers in its collection of the 35 most advanced countries today.

Globalization and the Metaverse

But, the tide of globalization, as all tides do, soon ebbed once more. If Covid-19 forced the once-bustling metropolises of developed countries to a grinding halt, then the urban centers of the developing world were decimated. Suddenly, the lauded benefits of globalization submerged into nightmares – supply chains were destroyed beyond repair, and import-driven economies, like many of the formerly mentioned emerging markets, were shuttered. What were the citizens of these markets to do – was this finally the end of globalization?

Out of desperation, they turned to the last emerging market they had access to, the only one that had been both untouched by the coronavirus and that was antifragile to the concerns of their calamitous reality: the metaverse. As players naturally had more time, they began to scour the web looking for what they thought was entertainment. Instead, they found their next mode of employment, one that would be far better than any job they had ever had before, in a game that resembled the toys of their youth but which transformed their lives beyond their wildest dreams.

During this time, Axie Infinity, a game created by the studio Sky Maxis, first saw its user base in the Philippines skyrocket as players realized that farming Axie’s in-game rewards, smooth love potion (SLP), would exceed the wages they would have made from their jobs, most of which were lost during the pandemic. In a moment, as invention and necessity finally wed, the narrative entirely shifted – cryptocurrency wasn’t a tool for idle speculation, rather the combination of gaming and NFTs rescued citizens from pugnacious governments and wayward politicians who were determined to inflate away their lifelong savings. Now, they had a way to accrue savings – assets – that grew in line with inflation. For many, the promised oasis of financial security was a reality and it was all because of NFT gaming.

Indeed, Axie and its otherworldly growth was the culmination of tailwinds that had been growing in intensity for years. This past decade of crypto started with tokens, but the potential for community participation in crypto is much larger and is merely scraping the surface of what’s possible for crypto in emerging markets. Yield Guild Games, the premier play-to-earn gaming guild, is leading this charge. And this coming decade will see the marriage of NFTs and crypto through YGG, creating a new market where anyone can participate in a project simply by exchanging time for assets, rather than for fiat.

Assets are the future

Why is this important? Citizens of emerging markets are subject to licentious currency manipulation, preventing them from accruing wealth in any real sense. Any money they’ve saved is eventually washed away by the tide of hyperinflation. In another sense, $1 twenty years ago is roughly equal to $1.60 today. The technocrats of America and the EU can’t tame inflation: The writing on the wall is clear – the leviathan of inflation is a universal calamity that affects us all, not just developing nations.

But in truth, the apocalypse may be avoided. The solution to hyperinflation may be to transform the economy into one where people are paid for their labor with assets, and not fiat currency. Assets keep abreast of inflation and empower people – families can save over time and achieve generational wealth that will finally end the incessant cycle of poverty.

Yet, Axie is only one game and symbolizes the future of gaming and crypto. As the metaverse matures, players will want to diversify and have exposure to a variety of games, all with different rates of yield and risk measures. Viewing this emergent behaviour, Yield Guild Games was created – beginning as a way to offer Axies to those promising gamers and now expanding to a multitude of other games including League of Kingdoms. The success has been nothing less than astonishing, creating a new business model that seeks to turn the gaming industry on its head.

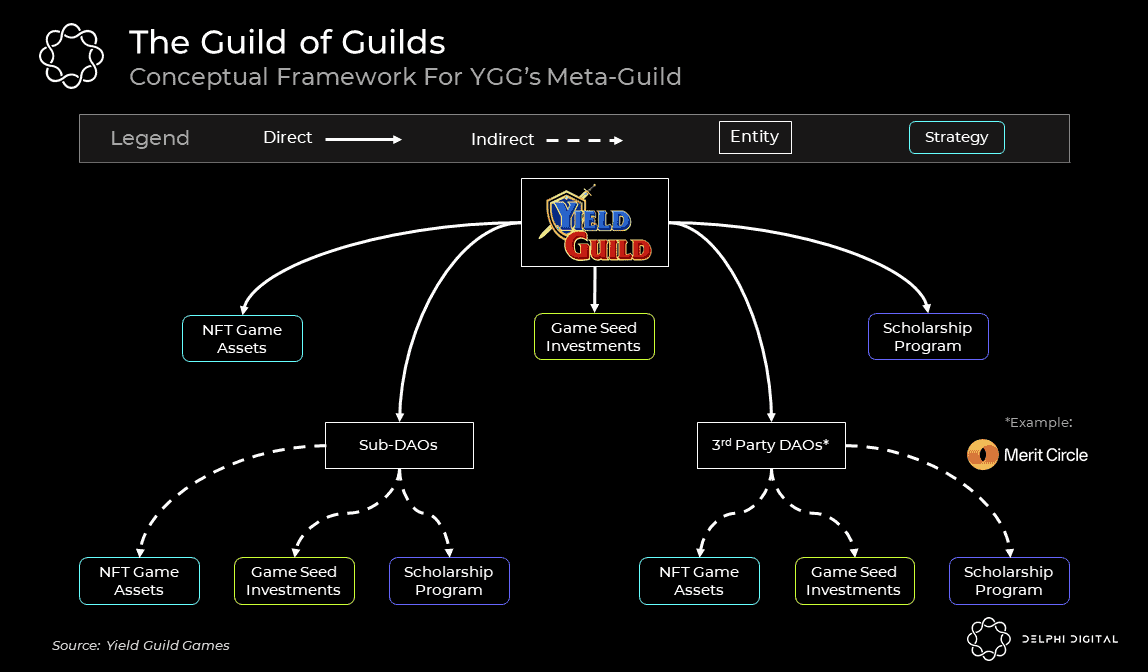

In truth, YGG will ultimately stand as the guild hall of the metaverse whereby the DAO both acts for the individual member, empowering players with scholarships and statistics to help them play high-yielding games, and where the entire community collectively benefits from the individual efforts of its members through various sub DAOs.

Why now?

New business models like play-to-earn are always intriguing concepts. Outsiders in the dotcom era were transfixed and later appalled by the notion that eyeballs on a page were more significant than revenue; years after the dust settled on the dotcom crash, Facebook proved that capturing attention was, in fact, more valuable than generating money. The former would inevitably lead to the latter, and lots of it, greater than most could even have imagined.

And, one could do worse than remember that Facebook was initially a haven for gamers with hits like Farmville. Still, consumers lost interest in gaming on Facebook – the incentives of the platform and that of the players were at odds and would never be reconciled because of those mismatched incentives. For if players were to truly benefit from a free internet, then they would be released from the closed wall of Facebook’s fiefdom. So, there was no easy way to port status or value onto another platform. The virtual farm they painstakingly built would languish for eternity in the metaverse.

This all changed during the pandemic, namely in the Philippines, which has always been a hub for emerging social technology. Axie Infinity’s positive-sum growth convinced the world that NFT gaming was a burgeoning industry and as success begets further success, Yield Guild Games soon came to the scene. Unlike the first wave of crypto projects that sought to keep the rewards for whales and the team – an exalted few – YGG decided to shift gears; players would receive items at no cost and would also earn the majority of the proceeds they generated from in-game activity. YGG was built not with investors, but with the gamers themselves in mind.

This was an epochal moment. The applications for YGG scholarships blossomed, resulting in more scholars, which led to higher in-game NFT prices, thus attracting more players. Just like that, a new market was born. Because of the metaverse’s endless frontier, this economy is poised to be the last emerging market. YGG is its steward, organizing the value in blockchain based gaming and splitting the proceeds with those who cultivated this new land. Unlike the disastrous consequences of colonialism, the settlers of these games own the property they cultivate with their private keys – what they build is theirs to keep. Instead of Soviet Russia, YGG is creating the next America in the cloud: the final frontier in many ways.

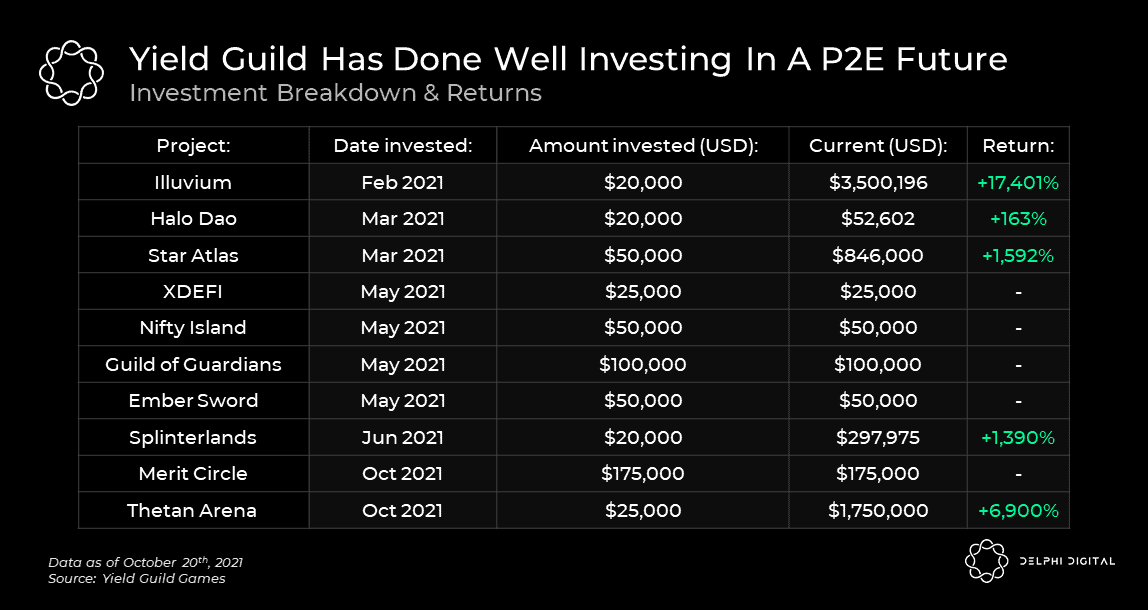

So far, the Axie experiment appears to be working and players are pleased with both the game and the incentives. Still, YGG isn’t banking solely on Axie – the guild has nearly 20,000 NFTs spread over 12 games, and is well positioned to bring more in as they become available. In a reflexive process, the wisdom of the crowd is continually learning and the network effect is only getting stronger with more than 50,000 people in the YGG discord.

Certainly, the future of NFT gaming is bright. As the incumbents of traditional gaming have failed to keep up with innovation, YGG is the shining north star for anyone to enter the metaverse. Indeed, the restless spirit of Melville is still alive today. Like the pilgrims who escaped their torturous reality by creating a shining city on a hill for all the world to see, YGG is assembling a collection of individuals with shared experiences and culture that are all working towards creating a new land, a citadel that is truly free and unshackled from the tremors of reality, and perhaps the last one we’ll ever need.

If you're interested in all of Fintech, join 10,000+ subscribers at Fintech Today!

Were you forwarded this email and want to sign up for yourself? We gotchu, just click here.